Most property owners focus on the moment they want to sell. In reality, the outcome of a sale is often decided much earlier - sometimes even at the moment the property was purchased.

In Abu Dhabi’s current market, demand is strong, but buyers are more selective, banks are stricter, and pricing mistakes are punished quickly. This is why some properties sell fast and others sit on the market for months with no serious offers.

Below are the key reasons why many investors lose money, time, and leverage when selling.

One of the biggest risks is overpaying at the buying stage.

Off-plan units purchased at peak developer pricing, especially with aggressive payment plans, often struggle in resale. When the unit reaches the secondary market, it competes with newer launches, incentives, and bank-driven pricing.

In many cases, investors who enter slightly later - through resale - are better positioned than those who paid full launch prices without margin.

Market value is not defined by hope. Even if a seller believes a property “should” sell for more, banks rely on recent transactions. When asking prices move ahead of valuations, mortgage buyers disappear. Once this happens, the pool of buyers shrinks to cash-only demand, which reduces competition and weakens negotiating power. Correct pricing means positioning the property where real buyer demand exists, not reducing its value.

Buyers are not buying your story. Custom finishes, emotional attachment, or personal upgrades rarely add proportional value. In many cases, they create friction instead of appeal. Professional investors separate emotion from numbers. The market responds to layout, condition, location, and price - not memories.

Many sellers confuse flexibility with weakness.

Real flexibility means understanding what matters to the buyer. Sometimes it’s timing, furniture, or the payment structure.

Small adjustments can unlock a deal without damaging the core value of the asset. Refusing to adapt often leads to longer holding periods and higher opportunity cost.

Rental income is important, but structure matters. Long-term rental contracts limit who can buy your property. Even strong buyers walk away when exit timelines are unclear. Shorter rental cycles keep your options open and preserve resale liquidity.

Before any viewing, buyers judge the property digitally. Poor photos, weak descriptions, and unclear layouts reduce interest instantly. This often leads to fewer enquiries and lower offers - even if the property itself is good. Strong presentation creates competition. Competition protects price.

Unrepaired issues raise questions about overall maintenance and ownership quality. Buyers rarely voice these concerns directly - they simply adjust their offer downward. Fixing small problems early often costs less than the price reduction buyers expect.

Real estate markets reward preparation, realism, and timing. Sellers who understand pricing dynamics, buyer psychology, and exit strategy protect their capital. Those who ignore these factors often lose leverage long before negotiations begin.

For a clearer breakdown, watch our full video on YouTube, where we explain each mistake in detail and show how to avoid losing buyers and leverage.

ADM: 202402335860

+971 504494150

info@ibuyrealestate.ae

Visit our office on Saadiyat Island - Soho Square B, G09

Don’t Sell Your Property in Abu Dhabi Until You Watch This

Newest Beachfront Mansions and Villas Between Abu Dhabi & Dubai | Bayn by Ora

Touring a 4-Bedroom Villa in Jubail Island | Sea & Mangrove Views | Abu Dhabi

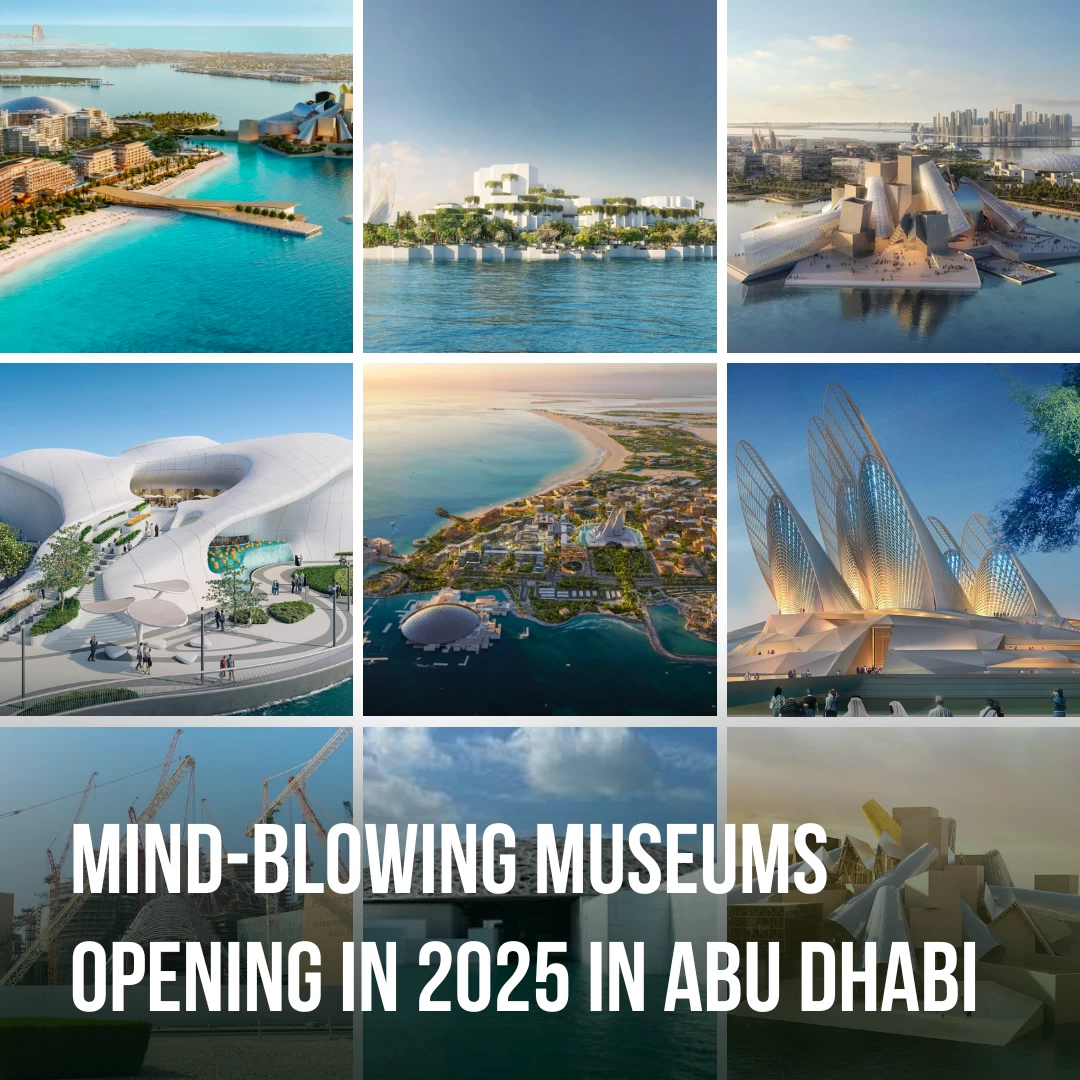

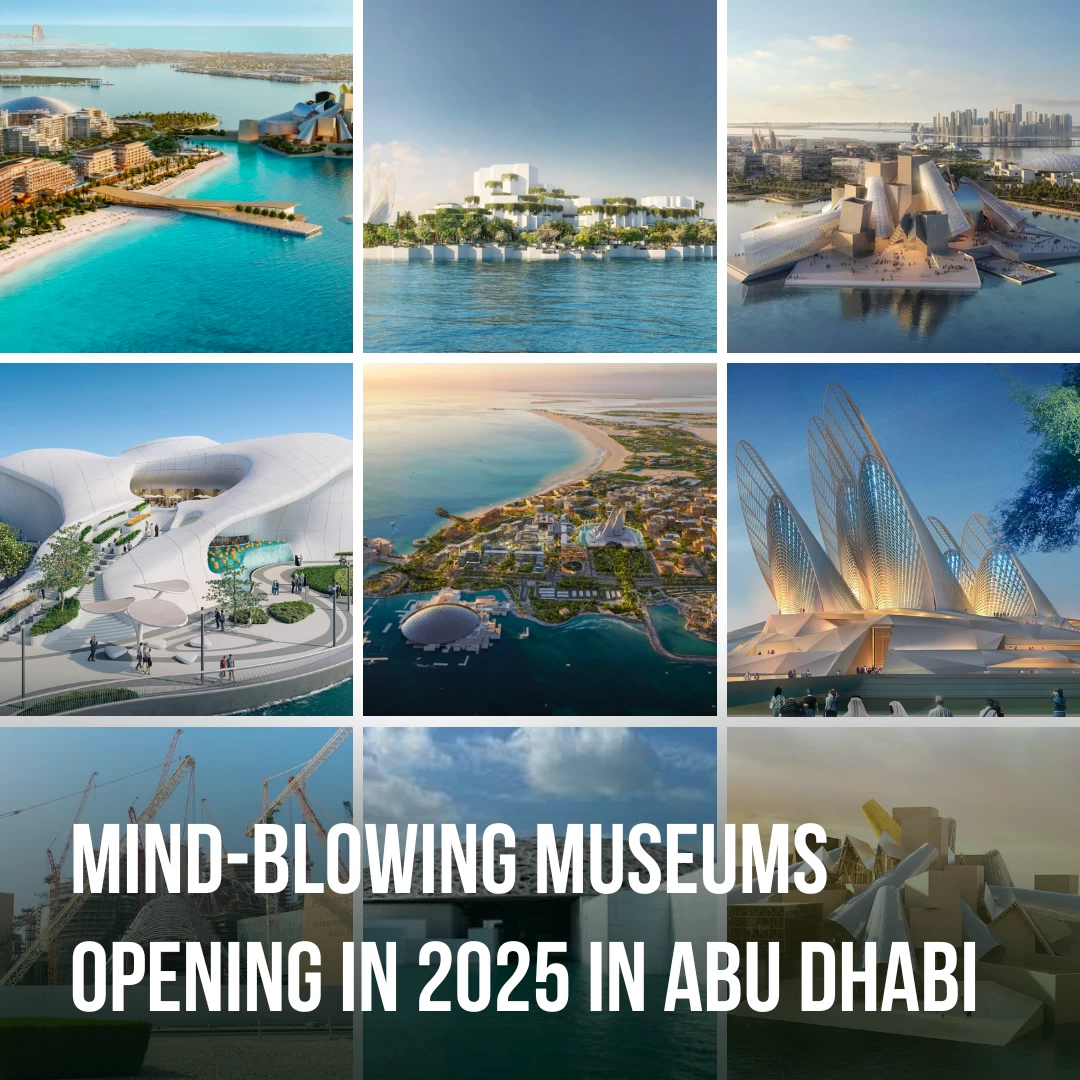

Smartest Property Investment in 2026: Saadiyat Apartments the Row surrounded by museums in Abu Dhabi